Deconfinement. What's next for tech entrepreneurs?

- Yannick Oswald

- May 12, 2020

- 4 min read

The key question entrepreneurs are asking themselves right now is 'when to open up'. You have followed the advice of your fellow entrepreneurs and investors, did a tremendous amount of hard work, perhaps did a bridge round, and now have a cash run rate of 12 months+. The first deconfinement tests have started this week in many places all over Europe. So, what are you supposed to do now?

My friend Zheng refers to the concept of bears in hibernation. When animals are in hibernation during the winter season, they can last longer, because they are immobile and conserving their resources. Like startups, bears are special. Their body temperature decreases much less compared to other hibernators, and their muscles remain in good condition, provided that they have stored enough body fat. Bears can reactivate quickly and forcefully when the winter is over.

Let's take a step back and have a look at some variables to consider before getting out of hibernation and roar again!

(1) Are your customers ready?While politicians are slowly lifting lockdowns to 'save the economy,' the real question startups need to ask themselves is: 'Are my customers ready to use my product as they used to?' There is no point in fully ramping up operating costs with only a fraction of your demand back. This chart from the NYT times provides some insights (thanks for sharing Phil).

You need to figure out if your customers' trust is back. Optimistic by nature, this is hard to do for entrepreneurs and requires discipline. My advice to our portfolio companies is to do consumer surveys and, then, keep whatever growth budget their financial plan allows them to test as much as possible, even if at a smaller scale than usual. If you experience a surge in demand, stay focused, and try to understand if it is a sustainable trend or not.

(2) Can I raise venture money now?The answer is yes. But timing is not ideal for everyone. There is plenty of capital in the market, and if you have a great asset in your hands, you will raise money. Most VCs, including ourselves, of course, are open for business. But the reality is that, out of the ones I've talked to, many are less active, and more demanding than pre-COVID. As early-stage VC Josh puts it well in this podcast, it is tougher to have a growth mindset for investors when they are sitting at home trying to make sure everyone is safe, and their companies ready for the challenges ahead. A more defensive mindset is the natural result. This chart by the team at Angular illustrates this well. For the first time in years, VC funding has decreased YoY in April.

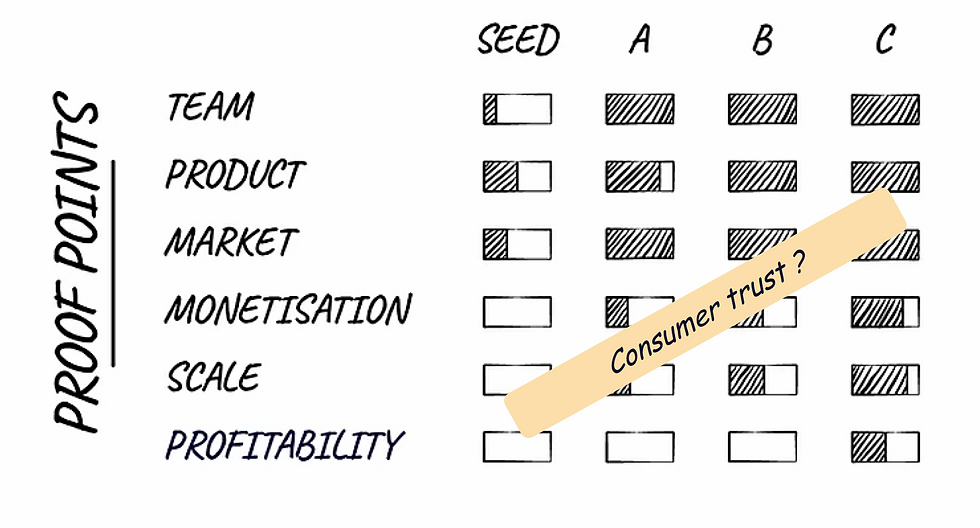

As we discussed in this post, timing is everything when it comes to fundraising. Entrepreneurs should always try to go out and raise money at their maximum point of leverage. With the current crisis, investors are essentially looking for another key proof point, consumer trust, and this across stages.

The positive thing about COVID is that we see accelerated digitization across industries, be it consumer or B2B. Venture investors are looking for businesses that are growing fast and can generate outsized returns. So, if you are going out now, make sure to articulate, based on data, how your business is seeing or will see an increased demand in the near future. Make sure that you include in your pitch what you have accomplished so far, how your old strategy has evolved into a better one, and how this new approach will accelerate your business either DURING or AFTER COVID.

Here a picture of my latest run. Weather has been great in Northern Europe these last weeks... This may be a good omen for what's to come.

Let's roar again!

Yannick

***

Content that I have found interesting:

- Latest TV commercial of our company Sybel. Audio entertainment will be a new form of mainstream entertainment, and Covid-19 has just accelerated its adoption massively...

- 'Content is the new core business' by my friend Didac, co-founder of Galdana Ventures and FC Barcelona Board Member. The world's best soccer club has become a media company. This is a big deal. In this post, Didac explains why it is important to put this news in context and realize that this is only the tip of the iceberg of a much broader vision.

- A great thread by Mary on the resilience of cloud computing stocks. Bessemer's cloud computing index's rebound has been faster and steeper than that of the broader market.

- Another brilliant and forward-looking post by my friend Peter on how this crisis is an opportunity for LPs to re-evaluate 'how they build'. 'It’s impossible to say what the outcomes of our actions in this current crisis will be, let alone those of other investors and market participants. However, I believe by re-orienting our view towards the longer-term the score will ultimately take care of itself. On the other side of this crisis we’ll be even better positioned to build, and to support other great investors as they build.'

- An optimistic post by Pierre from Frst in Paris on why the coming months are the perfect opportunity to do new things and find problems to solve. Here at OpportunitiesEverywhere, we couldn't agree more... He addresses a couple of interesting areas, but more importantly, he wants to inspire readers to see a personally-felt problem from a different angle and think of solutions...

- With the current crisis, this post on digital nomads with Liat Aaronson from August 2019 seems more relevant than ever. If you are are building a product in the nomad space, please feel free to reach out 👉 yannick@mangrove.vc

Comments